What is Layering?

Layering is a technique for obscuring the origin and destination of illicit funds by adding extra levels of complexity to the transaction trail. Cryptocurrency is laundered through numerous transfers to intermediate addresses and third-party services, making it harder to trace the flow of funds.

Layering is a common practice for criminal perpetrators seeking to shield their identities and launder proceeds from fraud schemes, thefts, hacks, extortion rings and other illicit activity.

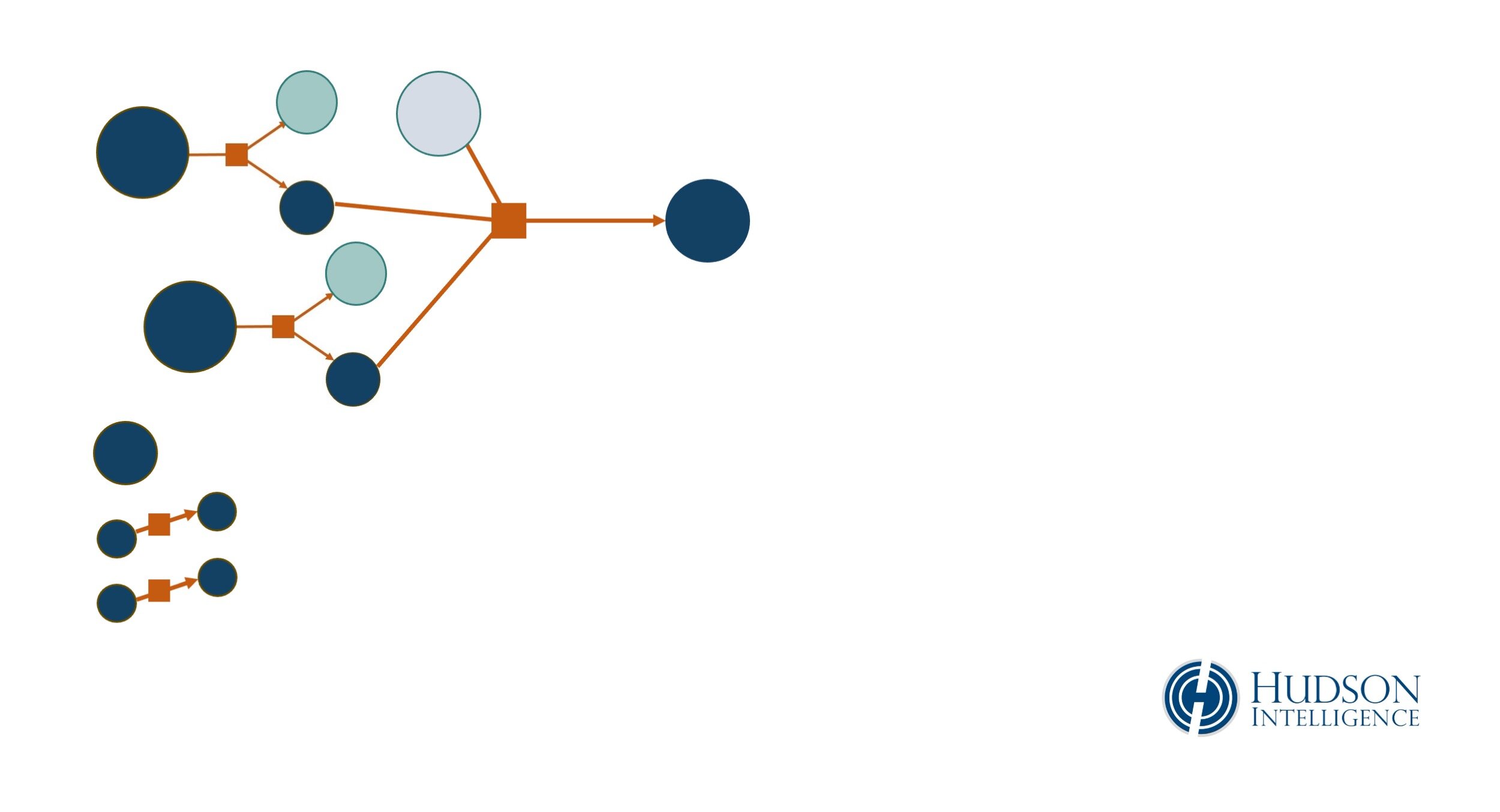

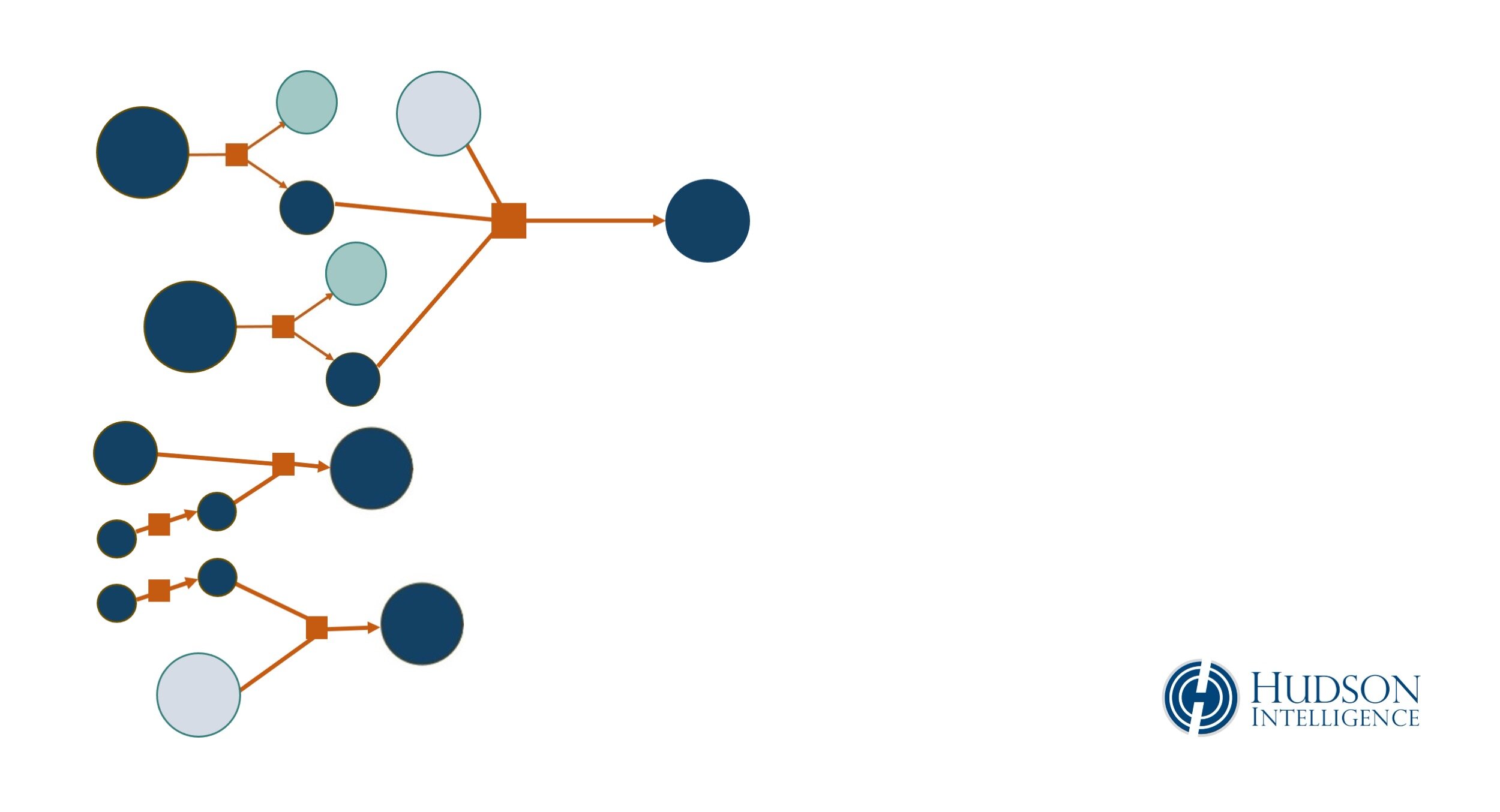

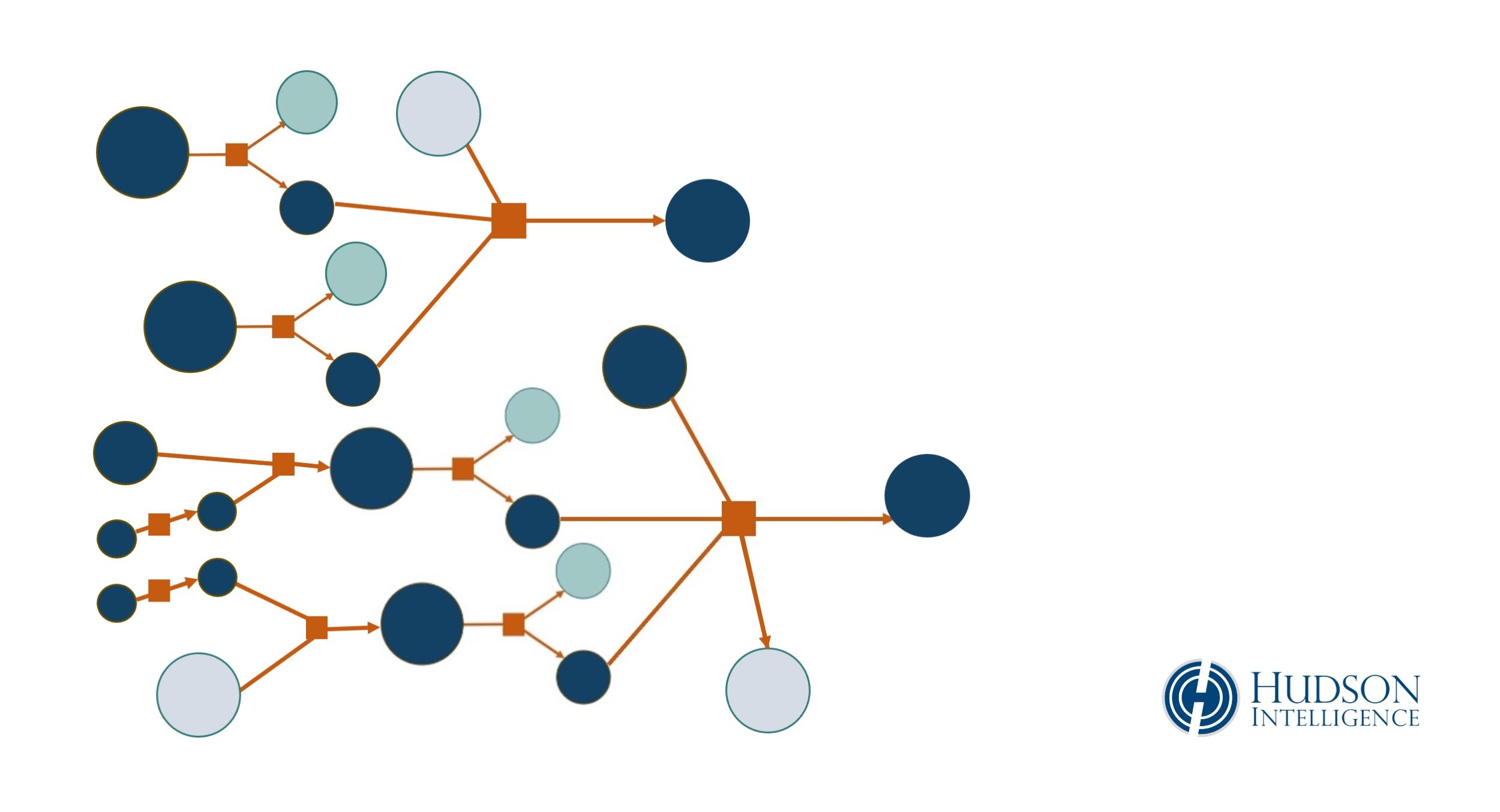

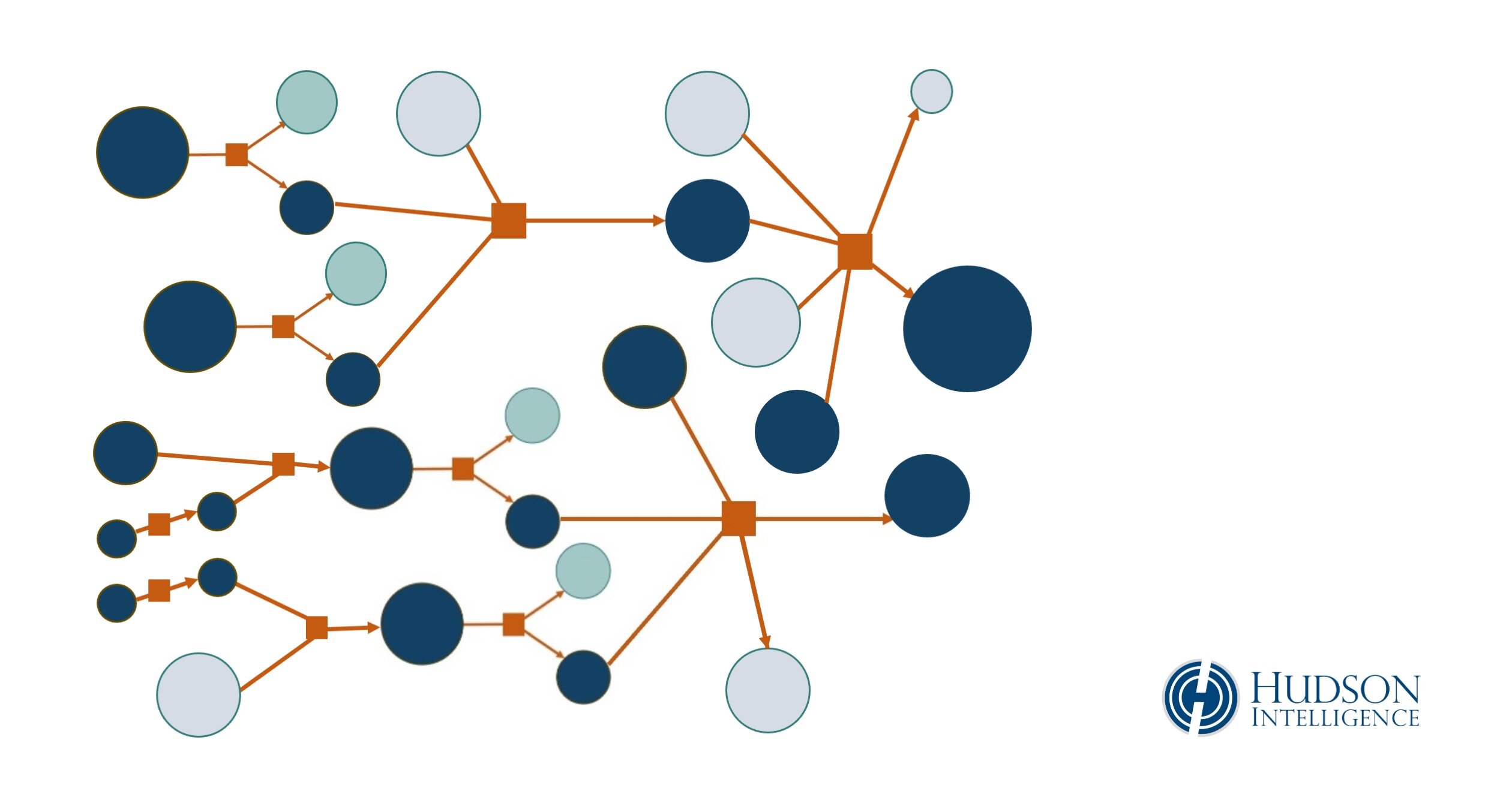

A Quick Look at Layering

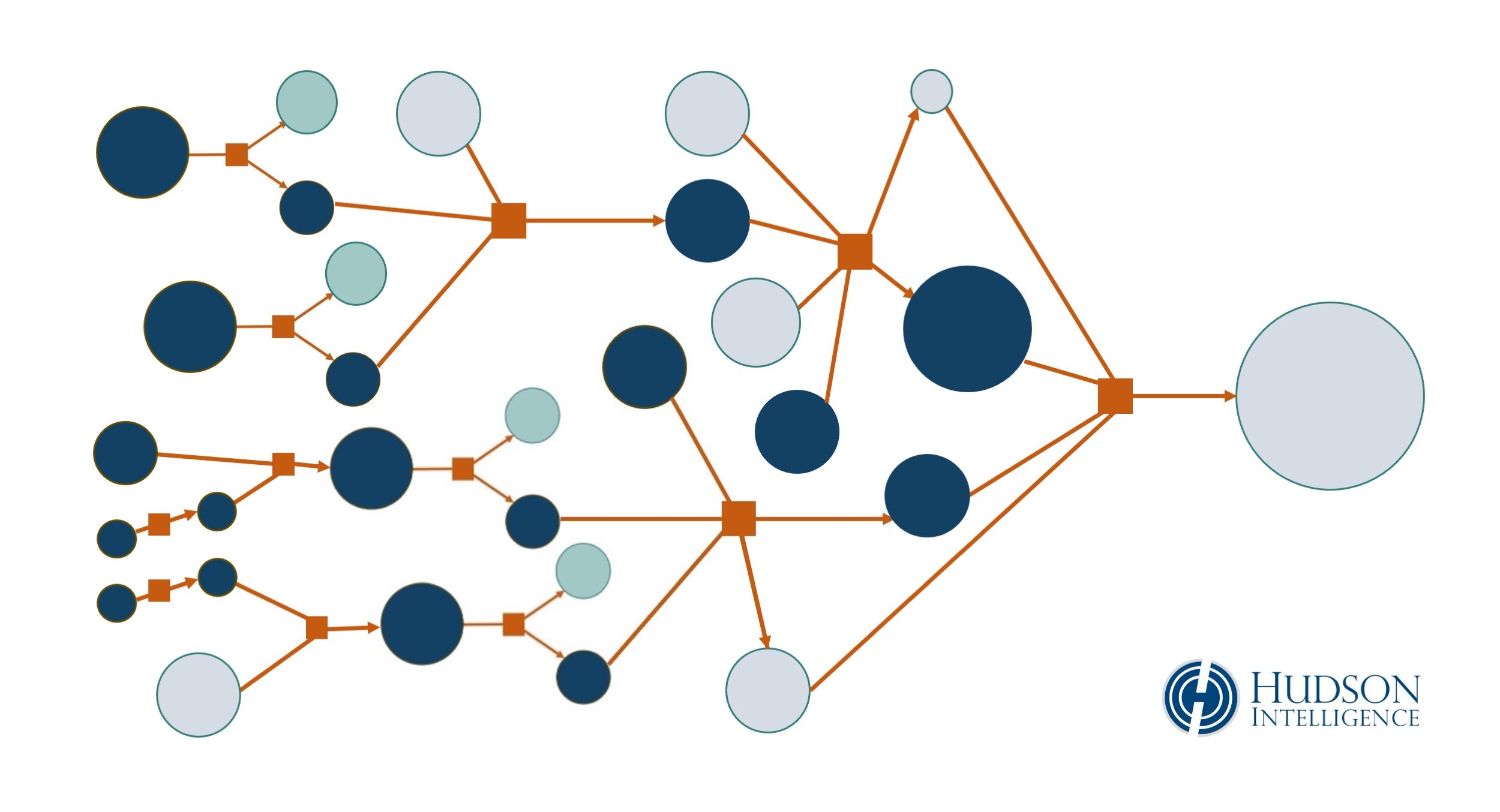

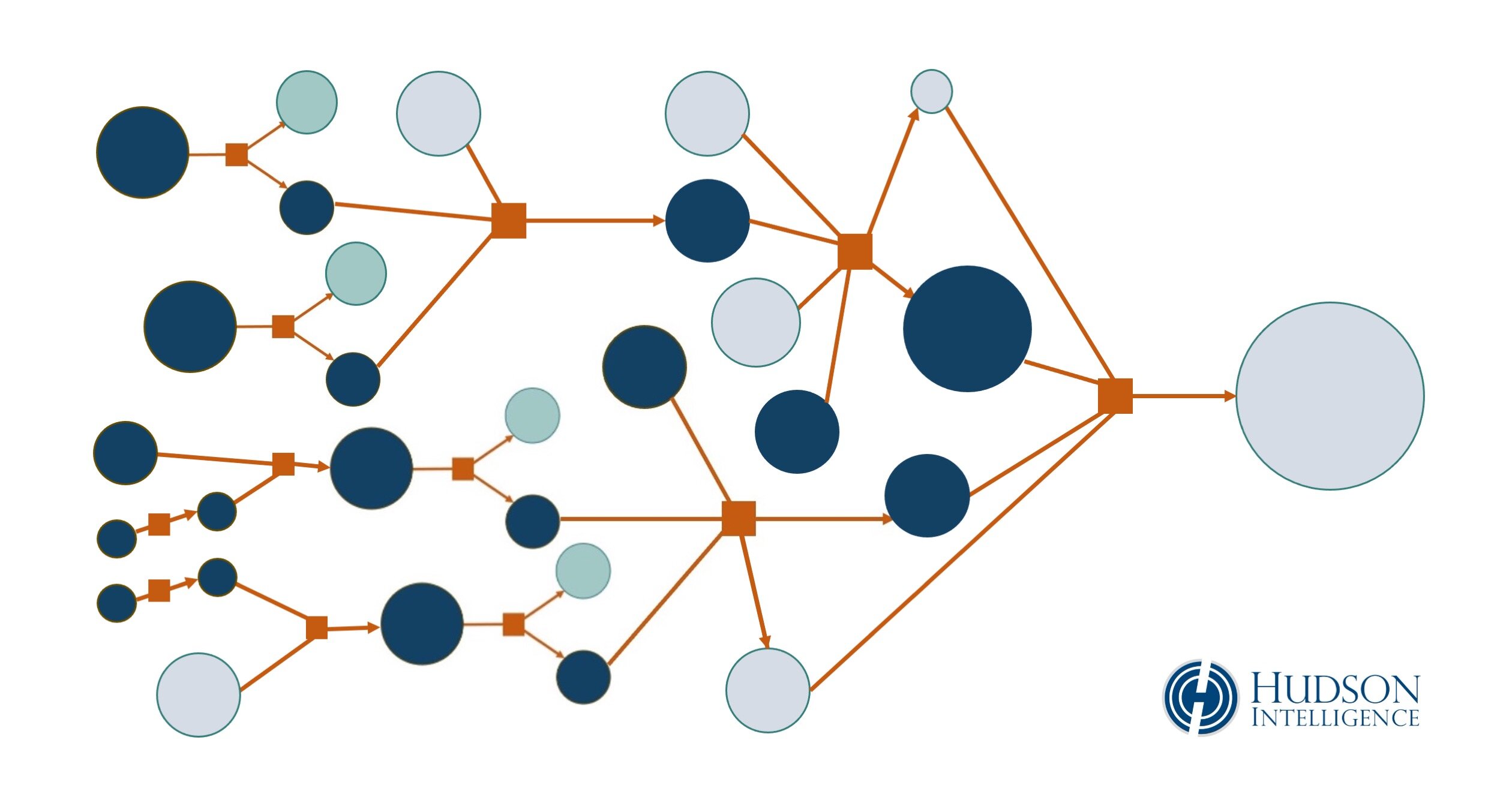

Illustrated below is a visual depiction of layered transactions, similar to how such data is rendered by blockchain intelligence tools. It shows a complicated jumble of transactions culminating in a final large-value transfer. The output address in this example reflects a consolidation of scattered assets controlled by the subject of an investigation.

This example illustrates a generalized, pared-down version of layering. Actual work product in a blockchain investigation would include cryptocurrency addresses and transaction hashes for every transfer, as well as ownership and attribution data, as available, for each relevant link in the chain.

Layering and Laundering

Fraudsters and thieves layer transactions by transferring cryptocurrency through numerous intermediate addresses under their direct control. Cryptocurrency is also laundered through numerous third-party services, such as coin mixers, dark markets, online casinos, decentralized finance, and peer-to-peer exchanges. Many of these platforms lack KYC/AML controls to verify customer identities or the legitimacy of income/asset sources, making them ideal environments for money laundering. Moving funds through multiple opaque channels can make it more difficult for an outside observer to trace the flow of tainted assets.

Can Layering Make it Impossible to Trace Cryptocurrency?

Layering is intended to obfuscate the blockchain audit trail. Technically adept and sophisticated perpetrators may succeed in using layering to impede cryptocurrency tracing and evade financial surveillance. However, these methods are not foolproof. They may slow down an investigation, or they may simply show the perpetrator has been running around in circles, executing transfers with himself in a closed loop.

Blockchain investigators and law enforcement have developed innovative techniques to untangle long, illicit trails of cryptocurrency. Investigators exploit privacy-exposing vulnerabilities in layering schemes, including address reuse and common spend, which can spoil the best laid plans of money launderers.

Consult an Investigator

Hudson Intelligence assists law firms, businesses, public agencies and investors with cryptocurrency investigations and due diligence. Every investigation is led by a Cryptocurrency Tracing Certified Examiner (CTCE) and Certified Fraud Examiner (CFE). If you would like to discuss a potential investigation, please complete the form below. We also suggest reviewing our FAQ.